“There’s a reason why your windshield is bigger than your rearview mirror. Where you are going is more important than where you came from.” – Anonymous

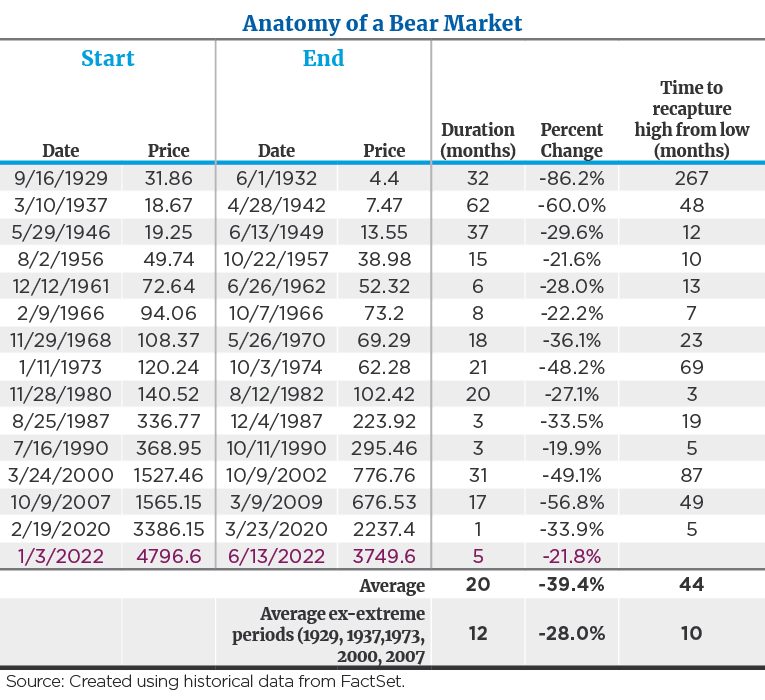

As I was ruminating on last month’s commentary about the horrible first half in the equity markets in 2022 that saw the S&P 500 decline more than 20%,1 I noted that historical stats regarding weak starts to a new year, from a performance standpoint, contained good news. I casually mentioned that in the five prior times during which the market fell more than 15% in the first six months of a calendar year (1932, 1939, 1940, 1962, and 1970), the average return in the second half was a robust 24%.2 I was very clear in stating that, despite having a positive outlook from here and expecting double-digit returns over the next 12-15 months, we were not forecasting that type of immediate, magnanimous recovery coming out of the locker room at halftime. We remain positive over this longer-term time frame, but we continue to believe there are still some hurdles to clear before we feel comfortable declaring the market has bottomed and that it is time to buy on the dip. Our message is still “hold your ground” and hover tight to your long-term targeted allocation to stocks. We are not yet ready to get more enthusiastic than that.

July: A Nice Breather

Regardless, the profitable market action in July was a very welcome respite! July was quite a month. Specifically, the S&P 500 advanced over 9%, marking its best monthly performance since November 2020.3 It wasn’t just July, though… the market has exhibited some oomph since mid-June. The S&P 500 is up more than 12% from the June 16 low, rising from 3,666 to 4,130 as of the end of July.4

Interestingly, the tech-laden Nasdaq gained over 12% in July, illustrating that some “risk-on” sentiment was resurfacing for investors.5 Growth stocks trounced value stocks, 12% to 7%,6 when comparing the Russell 1000 Growth and Russell 1000 Value indexes, leaving us grateful that we encouraged clients not to abandon growth but to embrace a blend of these two types of holdings in portfolios. In fact, the biggest change that we observed in the U.S. stock market in the last 30 days surrounds leadership. We saw leadership for the moment, shift to the more growth-oriented and aggressive areas of the market, such as the technology and consumer discretionary sectors. These sectors were the weakest performers in the first part of the year. It was defensive areas, such as staples and utilities and the commodity-oriented, inflation-resistant sectors such as materials and energy, that led early this year. This completely flip-flopped in July.7 So combined factors contributing to the state of the U.S. stock market included the shift in leadership, improving breadth and ability of the market to rise amidst tumultuous news. Those news headlines included reports that real GDP contracted by 0.9% in Q2,8 the Fed’s latest interest rate hike (75 basis points) and the continued rise in inflation.9

Economists Predict 50% Chance of Mild Recession

As a result of these events, economists increased the odds again to now more than 50% that the U.S. will experience some type of mild recession. This is all rearview mirror news, though. All this data was well telegraphed in advance, and the market participants knew it. The market is forward-looking, as are we in our thinking. Absolutes are not the key… it is the trend in the data and where the puck is headed, not where it is today, that matters. Per the quote above, there is indeed a reason that our rearview mirrors are small, and our windshields are quite large. Indeed, where we are headed is far more relevant than where we have come from.

Think of 2009 when the market bottomed in March of that year with the S&P 500 at 66610 in the midst of the housing implosion and the Great Recession of 2007-2009. The absolute news was still horrible. The U.S. was losing 700,000 jobs a month, and bank stress tests had just begun. The world was still fearful that major commercial and investment banks in the U.S. would vanish again, and the market knew about this bad state of affairs. What it anticipated was that the number of jobs lost would decline from 700,000 monthly to 600,000, to 500,000, etc. until by the end of 2009, no new jobs were being created but neither were they being lost. In other words, it appreciated the trend of things getting “less worse” and then in relatively short order getting better. U.S. corporations became very disciplined from an efficiency standpoint and vastly lowered break-even levels; profitability improved and then surged. The Fed provided needed liquidity, and the banks found religion on the capitalization front.

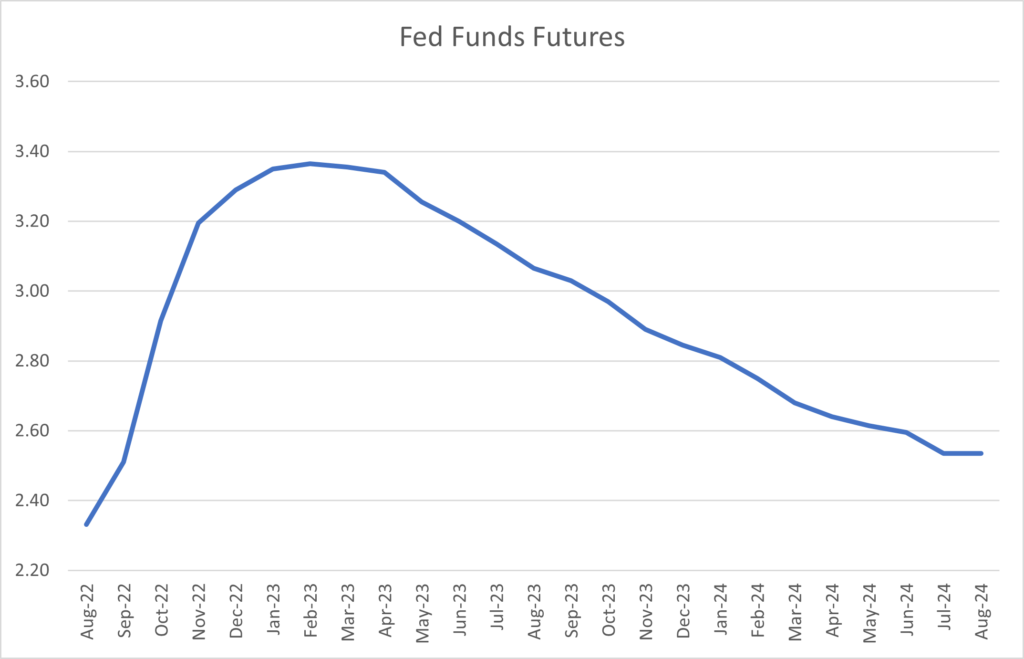

The economic restraint we are seeing today is nothing like that experienced back in 2009. What is common to that period is the trend in the data getting less worse and the market trying to find the bottom in the face of still-concerning news. For example, there are signs that the Fed may begin to pause their interest rate hikes sooner than feared only months ago as demand has slowed and inflation has shown signs of peaking via significant drops in commodity prices and a slowing in the rate of wage gains. The Fed funds futures curve suggests the Fed may stop hiking when rates achieve 3.75%-4% by year-end and that it may even be cutting rates by this time next year.

Regarding U.S. corporations, 70% are beating earnings expectations and providing guidance that is solid. It’s mixed and certainly not perfect, but it is better than feared, and the market is reacting to that news.

Billionaire and well-respected fixed income manager Jeffrey Gundlach said in a CNBC interview on July 29 that, in his opinion, the Fed has regained credibility in its efforts to tame inflation and has grabbed the reigns back in that effort. Gundlach doesn’t suffer fools gladly and scrutinizes data with the best of them. He went on to say the July rally was not a “sugar high” and that “The possibility of good returns, I’m not talking about in a month, but good returns over a 6–12-month horizon, have significantly improved.” While we are not ready to say with confidence that the bottom is behind us quite yet, we tend to agree with Gundlach’s assessment over the next 12 months.

Base Case—The Next 12 months

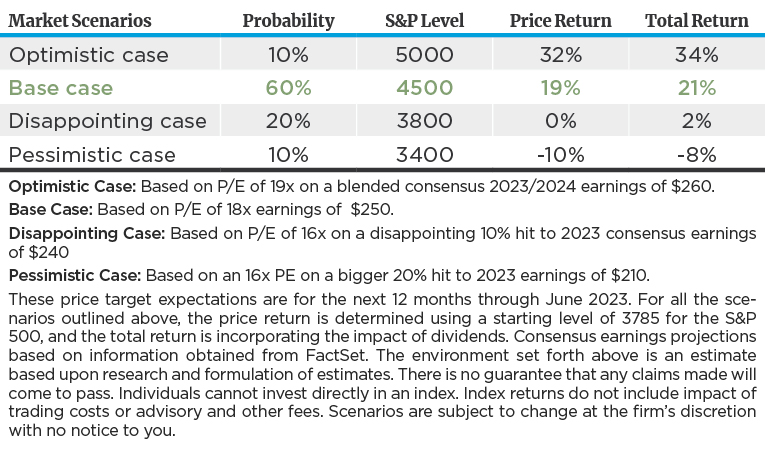

The table above captures our base case forecast for S&P 500 returns over the next 12 months. It also includes three other scenarios we believe are plausible but much less likely to occur. We also highlight the key assumptions we see accompanying this expected base case outcome. Specifically, we anticipate that the S&P 500 will rise from its current level of 4,000 or so to 4,500 by June 30, 2023. The catalysts for this are quite reasonable. To get there, we are looking at S&P 500 earnings of $245-$250 (versus current consensus of $246) and a slight increase in the P/E multiple from 17 to 18. We think such expansion is likely as investors get comfortable with the idea that inflation is calming, but we recognize this may take several more months of improving data to be confident that this will occur. In terms of the economic backdrop for our base case, we expect only moderately positive real GDP growth of somewhere in the 1%-2% area as activity picks up a bit in the third and fourth quarters. We’re looking for the Fed to institute more normal policy over the next year—neither overly restrictive nor accommodative. We place a 60% probability on this base case result.

In terms of the other scenarios, we think there is a chance that P/E multiples could expand to the 19 times level. This could happen if inflation starts to calm more swiftly than we expect at present. Should this occur, earnings would likely rise by 5% to the $260 level, and applying that multiple to such an earnings level takes the S&P 500 upside price target to 5,000. We only assign a 10% probability to this optimistic scenario.

In our disappointing case, we assume that inflation is stickier than expected and hence both earnings come in lower at the $240 level and multiples contract. This would be a mild recession and stagflation type of environment. We think that based on examining the historical drawdowns around past mild recessions, this scenario was largely discounted by the market at the June 16 low, when the S&P 500 had declined by 24%, peak to trough, in 2022. In such a case, the market would trade down modestly from here to the 3,800 level. We assign a 20% probability to this scenario.

In our pessimistic case, we assume a more than mild recession occurs with still sticky inflation; we see downside to 3,400 if this were to happen. Again, we view this as remote with a 10% probability of happening.

Why Hold Your Ground and Not Buy on the Dip?

Why are we stressing confidence yet caution right now in saying we think it’s best to stay at your normal stock allocation and not increase it a bit if we look for an S&P 500 of 4,500 in 12 months, which is handsomely above the current 4,100 level?

Our confidence in holding current stock allocations and not reducing them in the face of current headline concerns comes from the fact that key pillars of the economy and markets are still solid. Unemployment is still close to all-time lows at 3.6%,11 and we have never seen a recession begin at such low levels. Earnings remain positive and guidance is constructive overall. Economic activity, such as industrial production, is decelerating but from very high levels and is still healthy. The market has declined in advance of the anticipated but still not pronounced recession and has discounted to a large extent that one may occur. We know that the market rises during recessions almost half the time, so using history as a guide, most of the pain is already behind us.

What gives us pause, however, and makes us conclude that it is premature to add equity exposure just yet is that there are still a lot of unknowns. We are still experiencing major transitions. To name a few, inflation could reaccelerate; we think the Fed will cease interest rate hikes at year end, but that’s still uncertain; unemployment could spike if demand falls too much; shock events such as the Russia/Ukraine war are far from resolved, and surprises on that front could inspire a reacceleration in commodity prices; midterm elections are yet to take place in the U.S.

Wrap Up

Trends in the fundamental data appear to still be solid or moving in a slightly better direction than feared only a month or so ago. Leadership in the stock market and improving breadth paint a picture of a market that may be trying to bottom—that is to say, these are the elements that reveal themselves in prior bottoms. Recent interest rate and inflation trends imply price increases may be peaking and policy won’t have to be overly restrictive and worst case in nature. That said, a lot of important data will be released in the next 8-12 weeks that warrants analysis before changing our “hold your ground” view of the markets to something more confident. We’ll receive several inflation reports; several manufacturing and service sector surveys; several CPI prints; and several employment reports within the next eight weeks before the Fed meets again. In addition, the Q2 earnings season is yet to wrap up. Patience is warranted and needed to review this data before we can knowledgeably conclude whether the information is supportive of an inflection point and consistent with a sustainable market bottom just yet. Stay tuned!

Footnotes

1FactSet

2LPL

3-11FactSet

Disclosures:

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange.

The Russell 1000 Growth Index is the largest 1,000 growth stocks by market capitalization.

The Russell 1000 Value Index is the largest 1,000 value stocks by market capitalization.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.